NOTHING MATTERS WITHOUT OUR

HEALTH

Why Us

About us

My name is Yurii Illichov, founder of Krainity Insurance Solutions. I’m proud to serve individuals, families, and business owners by helping them find clear, personalized health coverage—without stress or confusion.

With a Law degree that sharpens my ability to do top-tier due diligence, I bring a detailed and honest approach to every conversation. Coming from Ukraine, I understand deeply how vital it is to protect your life and health. That’s why I named my company Krainity—a blend of Ukraine and Serenity—to reflect my mission of giving clients true peace of mind, safety, and stability through solid, reliable coverage.

To me, this work goes beyond business—it’s a form of spiritual service. I’m here to help make healthcare more accessible and affordable, while giving you the confidence that you’re protected.

our services

Health Insurance

The right health plan can protect you from high medical costs and give you access to quality care. Explore affordable options tailored to your needs, budget and lifestyle.

Life Insurance

Life insurance provides financial protection for the people you love. Secure coverage that’s simple, flexible and designed to support your family when it matters most.

Employees / Group Coverage

Provide your team with quality benefits without overpaying. Flexible group plans help protect employees, boost retention and support a healthier workplace.

Dental & Vision

Dental crowns and vision care can get expensive fast. Routine check-ups and the right plan help you avoid surprise bills and keep your smile and eyes healthy.

Critical Illness Protection

A serious diagnosis can bring unexpected costs. Critical illness coverage provides a lump-sum payout you can use for bills, treatment or income support.

Accidental Disability

An accident can impact your ability to work. Disability coverage helps replace lost income so you can focus on recovery without financial stress.

Accident Protection

Accidents happen and medical bills add up quickly. Accident protection helps cover emergency visits, treatments and out-of-pocket costs

100% Tax Write-Off

As a self-employed individual or business owner, you could potentially write off 100% of your health insurance premiums!

Reviews

get in touch

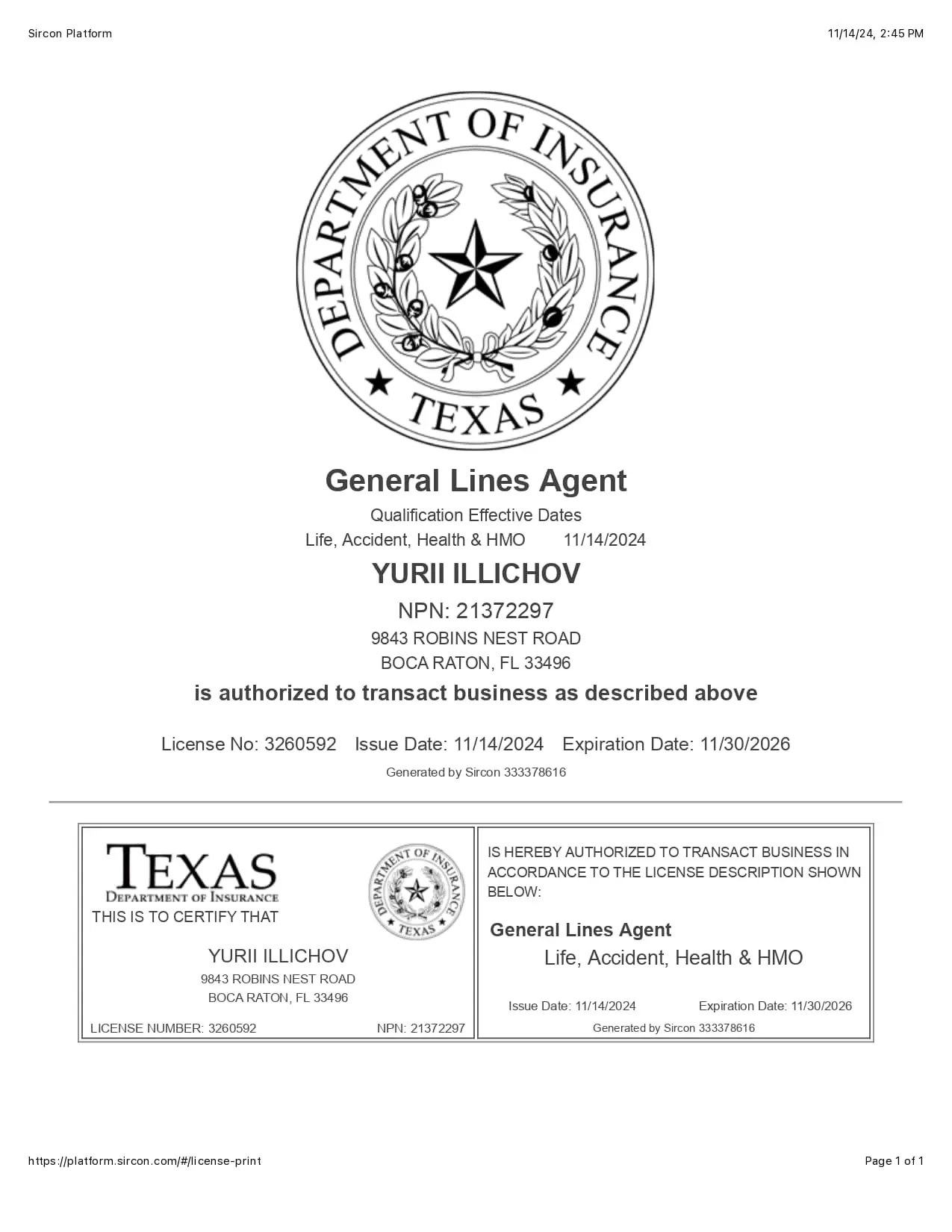

Licenses

FAQ

Will I Qualify for Private Health Insurance?

I Have a Pre-Existing Condition—What’s the Best Option for Me?

Does It Have to Be "Open Enrollment" to Sign Up for Private Insurance?

Short-Term Health Plans

Isn’t Private Health Insurance Really Expensive?!

What Are the Biggest Differences Between ACA/Obamacare, Employer Coverage, and Private Health Insurance?

- Employer Coverage – Great for employees because employers legally cover at least 50% of the premium. However, they are not required to contribute to family add-ons, making coverage for dependents significantly more expensive.

- Private Health Insurance – Medically underwritten, meaning you must qualify based on health. Because you're in a lower-risk pool, you get lower premiums, better coverage, and preferred rates, making it a more affordable option for those who qualify.

Can I Cancel My Plan Anytime?

Will Private Plans Cover Me Anywhere I Go?

Private plans provide nationwide coverage—on and off the job. Since they operate on major PPO networks, you’re not restricted to a specific county or state like many other plans. No matter where you go, you’re covered!

Deductible vs. Max Out-of-Pocket

Out-of-Pocket Maximum/Limit – This is the highest amount you will pay for covered services in a plan year. Once you hit this limit through deductibles, copayments, and coinsurance for in-network care, your health plan covers 100% of your covered benefits.

Generally, any expenses you pay toward your deductible also count toward your out-of-pocket maximum.

Have a Question Not Listed Above?

The Best Health Insurance for You, Your Family, and Your Team

Flexible Plans. Affordable Rates. Comprehensive Coverage.

Protect yourself, your family, or your small business team with tailored health insurance solutions. We help you:

-

Access to trusted medical networks and major carriers

-

Affordable, transparent plans

-

Dedicated licensed agent

Why Choose Krainity Insurance Solutions?

Health insurance is more than just coverage — it’s your financial protection. We help with:

-

Personalized Solutions: We provide health plans for individuals, families, and small businesses.

-

Expert Guidance: With years of experience, We help you choose the best plan based on your needs and budget.

-

Comprehensive Coverage: Medical, dental, vision, accident protection — everything you need, under one roof.

Group Coverage for Self-Employed & Small Businesses

Offering group health insurance is an essential benefit for small businesses and self-employed individuals. Here’s why:

-

Cost-Effective: There are plans on the private market that can save you money.

-

Tax Benefits: Small businesses may qualify for tax deductions when providing health insurance.

-

Attract & Retain Employees: Offering health coverage improves recruitment and employee satisfaction.

-

Wide Coverage Options: Access to medical, dental, and vision care for your team.

-

Streamlined Enrollment: We help ensure compliance and a simple, easy enrollment process.

How to Choose the Right Plan?

Choosing health insurance doesn’t need to be overwhelming. Here’s how we help simplify the process:

-

Assess your budget, health status, and coverage needs

-

Compare individual, family, and group plans for the best value

-

Guide you through tax deductions and available discounts

-

Offer personalized support to make the decision stress-free